🤑 Why Passive Crypto Income in PH 2025? UTP: Effortless Gains While You Siesta Passive income is the ultimate life hack, pare—earn while sleeping, without the daily grind of a 9-to-5. In the Philippines, with our love for quick wins (hello, lotto vibes), crypto fits perfectly. UTP here: Low entry barriers (start with as little as ₱500 on local apps), high yields (up to 20% APY on staking), and tax perks under BSP rules (gains under ₱250K might fly under the radar, but always declare to BIR to avoid chismis from the taxman). Joke time: Why did the Filipino crypto investor go passive? Because active trading was too "mahal" on his time—get it? Mahal as in expensive and love! Astig, no? The market's hot: PH ranks 9th globally in crypto adoption (Triple-A data), with 13% ownership vs. global 6.8%. Perfect for OFWs sending remittances via stablecoins.

📊 Platform Analysis: The Good, the Bad, and the Scammy From my deep dive (using 2025 reviews and scam trackers), most of the platforms you listed scream "scam alert!"—think fake AI promises, deepfakes, and zero regulation. Quantum AI? Classic scam with Elon Musk deepfakes. Trade Vector AI? Mixed reviews, but low trust scores on ScamAdviser (1/100). SALIK Profit? Tied to UAE toll scams, not crypto legit. ADNOC Profit? Fraudulent investment claims. The list goes on: NethertoxAGENT, EquiLoomPRO, Voryxa Yieldora—all flagged as high-risk with no real user payouts. Even "Automated Investment Platform Powered by Chat GPT Plus"? Pure fleeceware using AI hype to steal funds. In PH, stick to BSP-registered ones like Coins.ph or PDAX—avoid unregistered globals like OKX or KuCoin, as SEC cracked down in 2025, blocking 15+ for no licenses.

Here's a table comparing key ones (based on Trustpilot, ScamWatch, and PH SEC data):

| Platform | Legit/Scam | Why? (2025 Insights) | Rating (Out of 10) | UTP for PH Users |

|---|---|---|---|---|

| Trade Vector AI | Scam | Low trust score; fake reviews; no PH regulation; promises 100% wins but users lose deposits. | 2 | None—avoid like that suspicious lumpiang shanghai. |

| SALIK Profit/SALIK SHARES | Scam | Linked to Dubai scams; no crypto ties; fraudulent stock claims. | 1 | Zero; it's like betting on a rigged sabong. |

| Quantum AI/QuantumTraderX | Scam | FCA/SFC warnings; deepfake endorsements; drained wallets reported. | 1 | Promises quantum profits, delivers quantum regrets. |

| AE – Trade Master Biz | Scam | Unregistered in PH; fake AI trading; withdrawal issues. | 2 | "Master" of scams, not biz. |

| ADNOC Profit | Scam | Fake UAE oil investments; SEC flagged similar in 2025. | 1 | Oil and crypto? Sounds fishy, pare. |

| Robust Token | Suspicious | Low info; possible rug pull; no passive yields proven. | 3 | "Robust" like a weak adobo—skip. |

| Trade Edge AI | Scam | AI hype but scam reports; not DFSA-regulated as claimed. | 2 | Edges you towards loss. |

| Automated Investment Platform | Scam | ChatGPT knockoff; phishing via apps; FTC actions in 2025. | 1 | Automated? More like auto-scam. |

| Xivora Lunex/AffinexisAgent | Scam | Fake AI platforms; deepfakes in PH ads; no real returns. | 1 | Lunex? Sounds like a bad moon rising—scam vibes. |

| Amana Investments | Legit-ish | Regulated in UAE; but limited PH access; focus on halal funds, not pure crypto. | 6 | Stable for stocks, but crypto? Meh. |

| Coins.ph (Recommended) | Legit | BSP-licensed; easy staking/lending; 10M+ users in PH. | 9 | Astig UTP: Instant PHP withdrawals via GCash. |

| PDAX | Legit | SEC-approved; yield farming options; secure for Pinoys. | 8 | Local fave—trade in PHP, no forex hassle. |

| Binance (with Caution) | Legit | Global giant; but PH access restricted post-2025 SEC rules—use VPN wisely. | 7 | High yields, but watch for blocks. |

Bottom line: 90% of your list are scams (per DFPI/FTC trackers). Stick to local regulated ones to avoid "sayang" your hard-earned pesos. In 2025, SEC mandates registration for all CASPs—non-compliance means blocked access.

⚠️ Scam Warnings: Don't Get 'Lokohan' in 2025 Pare, the crypto world is full of "mga manloloko"—AI scams using deepfakes (like fake Elon vids for Quantum AI) spiked 25% this year. Signs: Guaranteed profits (impossible!), unregistered in PH (check SEC site), withdrawal fees that trap funds. Joke: Why do scammers love AI? Because it's "artificial" intelligence for real stupidity! If it sounds too good, it's probably a pig butchering scam. Report to PNP-ACG or SEC—over 86 investment scams flagged in PH this year.

📈 Deep Dive: Strategies for Passive Crypto Earnings in PH 2025 Passive means set it and forget it, di ba? Here's how to earn without staring at charts all day. UTP: Diversify for stability amid volatility (BTC up 50% YTD, but altcoins wild).

- Staking: Lock & Earn (UTP: Steady 5-20% APY) Stake ETH or SOL on Coins.ph—earn rewards for securing networks. In PH, use Proof-of-Stake coins like Cardano (ADA, 4-6% APY). Strategy: Start with ₱10K in ETH; compound monthly. Risks: Slashing if offline. 2025 tip: ETH post-Dencun upgrade = lower fees, higher yields.

Unlocking Passive Income in 2025: The Evolution of Crypto Staking ...

- Yield Farming: Liquidity Provider Magic (UTP: High Returns, Up to 50%+) Provide liquidity on DEXs like Uniswap via Binance—earn fees + tokens. In PH, use stablecoins like USDT to avoid volatility. Strategy: Farm on low-risk pools (e.g., USDT/USDC); rotate for best APYs. 2025 outlook: DeFi TVL hits $200B globally; PH adoption up 21% (Chainalysis).

Yield Farming | Definition, Strategies, & Risks | Britannica Money

- Lending: Be the Bank (UTP: Fixed Income Vibes) Lend on Aave or Compound—earn interest (4-15%). Strategy: Overcollateralize to avoid liquidation; use PHP-pegged assets. PH twist: Integrate with GCash for easy fiat conversion.

💰 Recommendations: Where to Invest Your Crypto for Gains For passive in 2025, focus on blue-chips. Top picks (per Forbes/Bankrate):

- BTC/ETH: Stake ETH for 5-10%; hold BTC for long-term (projected $150K by EOY).

- SOL/ADA: High staking yields (10-15%); SOL's speed great for DeFi.

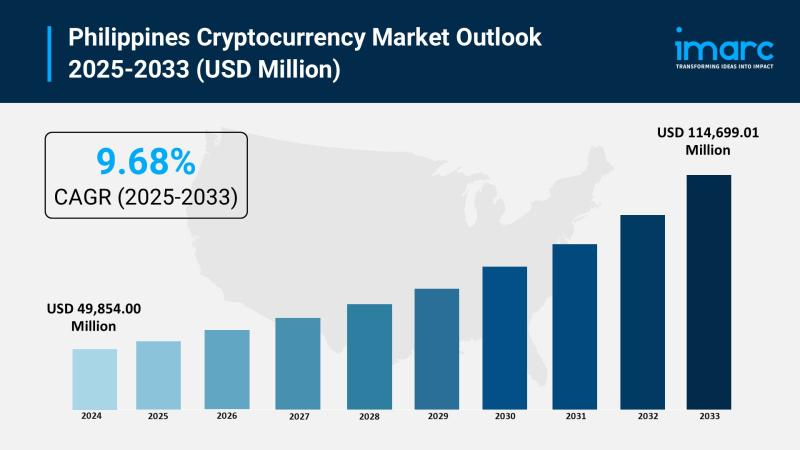

- Stablecoins (USDT): For lending/farming—low risk, 4-8% APY. Strategy: DCA (dollar-cost average) ₱1K weekly; diversify 50% stables, 30% ETH, 20% alts. Aim for 10-20% annual returns. Market outlook: PH crypto market grows 9.68% CAGR; invest via regulated apps to comply with SEC.

Philippines Cryptocurrency Market 2025 | Worth USD 114,699.01

📝 Step-by-Step: Registration, Login, Withdrawal in PH Let's keep it simple, pare—no need for rocket science.

- Registration on a Legit Platform (e.g., Coins.ph):

- Download app from App Store/Google Play.

- Click "Sign Up"; enter email/phone, verify via OTP.

- Upload ID (passport/driver's license) for KYC—takes 1-2 days.

- Deposit via GCash/BPI (min ₱100). Joke: Easier than registering for a fiesta raffle!

- Authorization/Login to Personal Cabinet:

- Use email/phone + password; enable 2FA for security.

- Dashboard shows wallet, staking options—click "Earn" to start passive.

- Forgot password? Reset via email—astig security.

- How to Withdraw Crypto in PH (2025 Rules):

- Go to "Withdraw"; select PHP to bank/GCash or crypto to wallet.

- For fiat: Instant to GCash (fees ~1%); comply with BSP limits (₱500K/day for verified).

- Crypto: Send to MetaMask; convert via PDAX if needed. Taxes: Report gains >₱250K to BIR (12% CGT). SEC rules: Only via registered VASPs—no OKX drama. Tip: Use UnionBank for seamless crypto-fiat bridges.

Wrapping up, pare: 2025 is your year for passive crypto wins in PH—ditch the scams, embrace staking/farming on legit platforms, and watch your portfolio grow. Remember, invest what you can afford to lose; DYOR always. If it goes well, treat yourself to lechon! Questions? Hit me up. Salamat! 🚀